A40. How can I send invoices by e-mail?

Conditions

The e-mail interface needs to be set up first before you can send unprinted invoices by e-mail. There must also be an unprinted invoice, and the recipient must have provided an e-mail address. This article shows how it works.

Settings for an invoice by e-mail

Please also check that the output options are set to Conditional and All Media. You can also save a standard e-mail template so that your customers do not only receive an invoice. More about this in the chapter "Depositing an e-mail text".

To access the first window, click on the Settings icon in the bottom right-hand corner, then click on Parameters, then switch to the Finances menu, and then select Template Editor in the Invoice Template drop-down menu. Now click on the blue folder in the middle of the new window.

Next, select Invoices on the right side of the new window and click Output Options in the upper right-hand corner. Here you can set the drop-down menus to Conditional and All Media. The argument INV_isDocument(«invoice») must be shown in the box marked in red below.

Depositing an e-mail text

In order to send not only the invoice by e-mail alone, an e-mail text template is required. Create an e-mail text template for the subsequent documents of the selected invoice. Then click on Output options in the upper right corner and set the output to "Always" and "Mail only".

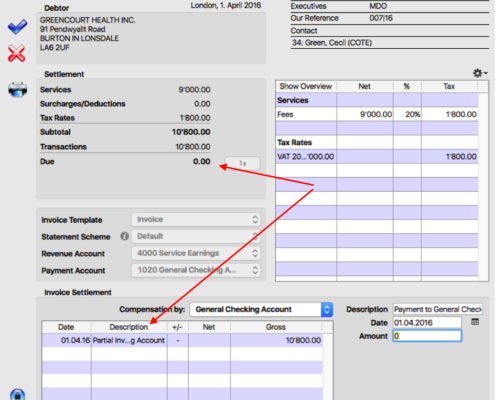

Depositing an e-mail address

Now you need to save an e-mail address (marked in red in the image) in the dossier of the invoice recipient.

Sending an invoice by e-mail

Continue to the Finance section, where you will find unprinted invoices under Accounts Receivable. Select the invoice record and click on the printer symbol at the bottom right. Then click on the small black arrow in the Draft field and select "Mail to ...". You can then edit and send the contents of the e-mail.

You also have the option of sending invoices by e-mail without having set up an interface. You can also send e-mails without an interface via clients or mandate folders.